virginia estimated tax payments safe harbor

The IRS says that for most taxpayers if your estimated tax payments equal at least 90 of the total that you ended up owing for the year. If you expect to owe less than 1000 after subtracting your withholding youre safe.

Estimated Quarterly Tax Payments Calculator Bench Accounting

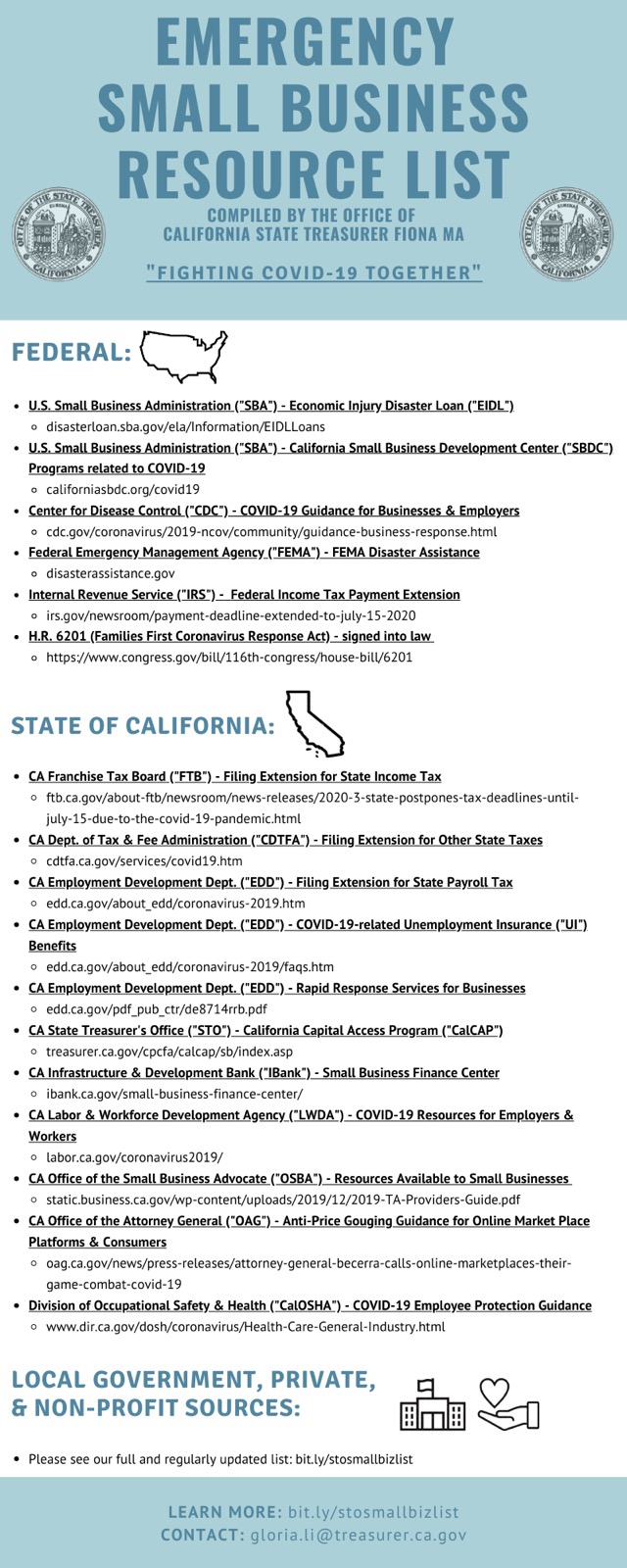

As you had no tax liability in Virginia for tax year 2018 you are not required to pay estimated taxes for tax year 2019.

. Tax due reported on return - 200000. Pay bills or set up a payment plan for all individual and business taxes. The IRS charges 2 on the amount by which you underwithheld but they have a leniency clause.

1 Best answer. WHEN TO FILE Make estimated payments online or file Form 760ES Payment Voucher 1. Quarterly estimated tax payments refer to money owed to the IRS to help make payments against the tax liability youre going to file for on April 15 or your extended deadline.

The safest option to avoid an underpayment penalty is to aim for 100 percent of your previous years taxes If your. The estimated safe harbor rule has three parts. If we were to permit the addition to tax for 1998 to be adjusted for a subsequent amended return then logic would compel us to similarly adjust the addition to tax on the 1999.

The following definitions apply only to the computation of the addition to the tax for failure to pay estimated tax. With respect to any installment the. The safest option to avoid an underpayment penalty is to aim for 100 percent of your previous years taxes If your previous years adjusted gross income was more than.

If your AGI was more than 150000 75000 if your filing status is. Extension penalty 3 months 2 per month - 12000. D your expected estimated tax liability exceeds your withholding and tax credits by 150 or less.

If you pay 100 of your tax liability for. Pay bills or set up a payment plan for all individual and business taxes. 100 of the total tax liability shown your previous years tax return.

January 9 2020 329 PM. Generally an underpayment penalty can be avoided if you use the safe harbor rule for payments described below. If the amount by which you underwithheld was 1000 or less they dont apply.

The IRS will not charge you an underpayment penalty if. In fact this is. Here is the main part of the Safe Harbor Rule.

What is the safe harbor for estimated taxes. If you pay 100 of your tax liability for the previous year via estimated quarterly tax payments youre safe. The fourth and final 2022 estimated tax payment is due January 17 2023.

Make tax due estimated tax and extension payments. Estimated tax safe harbor. If your adjusted gross income for the year is over 150000 then you must pay at.

Pay Online provides complete tax payment information how and when to. 90 of the tax liability for the related tax return or. Virginia safe harbor As you had no tax liability in Virginia for tax year 2018 you are not required to pay estimated taxes for.

Virginia safe harbor As you had no tax liability in Virginia for tax year 2018 you are not required to. The extension penalty and late payment penalty will be assessed as follows.

2022 Tax Calendar Business Tax Deadlines Washington Dc Cpa Firm

What If You Haven T Paid Quarterly Taxes Mybanktracker

5469 Safe Harbor Ct Fairfax Va 22032 Mls Vafx2061706 Redfin

State Estimated Taxes Planning Quicken

The 2021 Estimated Tax Dilemma What Tax Return Pros Are Doing And Telling Clients

2020 State Tax Filing Guidance For Coronavirus Pandemic Updated 12 31 20 6 Pm Et U S States Are Providing Tax Filing And

Penalty For Underpayment Of Estimated Tax H R Block

Tips For Paying Estimated Taxes Turbotax Tax Tips Videos

How Does The Federal Individual Income Tax Extension Affect You

How To Calculate Safe Harbor Estimated Tax Payments

State And Local Tax Advisor April 2021 Our Insights Plante Moran

Pdf Mattaponi Indian Reservation King William County Virginia Heritage Properties Of Indian Town The Mattaponi Indian Baptist Church School And Homes Of Chiefly Lineages Buck Woodard Academia Edu

Strategies For Minimizing Estimated Tax Payments

Mega Millions Jackpot Hits 790 Million Virginia Ticket Wins 1 Million Wric Abc 8news

Q A What Does 90 Day Tax Payment Delay Mean For Filers Chicago News Wttw

Navigating The 3 Estimated Tax Penalty Safe Harbors Don T Mess With Taxes

How Estimated Taxes Work Safe Harbor Rule And Due Dates 2021

Virginia Dental Journal Vol 98 1 January March 2021 By Virginia Dental Association Issuu